Does the J. Hartman Company have a crystal ball? It certainly seems that way; they do make wise choices about which American cities to choose for investing in real estate.

According to Jason Hartman, founder of the Platinum Properties Investor Network, the five most profitable cities to invest in income property are Indianapolis, Austin, St. Louis, Cincinnati and Pittsburgh.

Indianapolis is number one with 1.7 million people of the metro living good based on the affordability of housing, unemployment and the cost of living. Nearly 95% of the homes are affordable to families earning the median salary and the unemployment rate is low; 8.2% compared to the national average of 9.4%. Investors have found great deals on newer homes in Indianapolis as a result of the national housing mortgage meltdown.

Another area of interest is Austin – Round Rock area in Texas. This is one of the fastest growing areas in the country ranking number three on the affordability list. An economic paradox, high demand and low prices; the area has lots of available land and plenty of financing for real estate developers to get in on the action. Another great advantage to the area is the regulatory climate there is easy on the builder. Another amazing statistic – one suburb area north of Austin, Hutto, has grown in population from 1,200 as recorded in the 2000 census to a whopping 17,000!

Rounding out the top five on the affordability list are St. Louis, Cincinnati and Pittsburgh. Though they have slightly higher unemployment numbers, these cities still come out on top du to comparatively cheap housing. It’s no secret that food, utilities, transportation and health care are more expensive in costal regions.

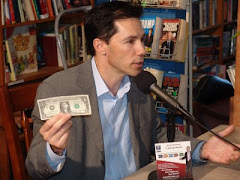

Jason Hartman of the J. Hartman Company and Platinum Properties Investor Network firmly believes that income properties are a wise investment strategy. With the proper use of leverage you can safely put $20,000 down on a $100,000 property to control $100,000 in assets. This is not always so in the stock market where the same $20,000 could easily be wiped out in a crazy market day.

Income Property Investments without Excuses!

15 years ago

Great post; very interesting

ReplyDeleteI enjoyed reading this; interesting choices for places to live and invest

ReplyDeleteWow; I learned a lot from this one! Very interesting!

ReplyDeleteGood post; something to consider if I decide to relocate for retirement

ReplyDeleteJ. Hartman Company, and Platinum Properties Investor Network has some great Real Estate Investment articles and wealth building tips. thanks Jason

ReplyDeleteJason have check you out-- great show!

ReplyDeletegood job

ReplyDeleteThis gives me a good idea of where I want to live!

ReplyDelete