No matter what business you’re in, whether it be your own business or if you’re working for someone else, you need to have sales skills. Even with your own personal life, children, parents, brothers, sisters and friends, you want to know how to sell your ideas.

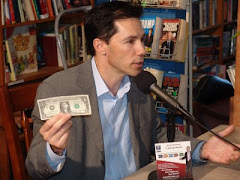

Will Crist of Sandler Systems, Inc. is a trusted advisor to business owners and entrepreneurs. He helps with company cultures, sales skills and personality assessments. People often come to Will because they are frustrated; they are not getting the results they want in their business. Their sales people are saying they cannot expect to make sales because of the market, competition or they don’t have the right product for the right price. These are common issues that people look to Will Crist for advice on overcoming.

According to Will Crist the first part of the Sandler method is to change the whole notion of what we mean by selling. It isn’t all about getting someone to buy something from you; your first step is to find out what they want, how you can help them; what kind of issues they have and the reason they would buy something. Will Crist calls this the “pain.”

It is important the buyer feel that they are in control while you guide the conversation to a decision, even if they say no. You don’t want to leave things at “Let me think it over,” because this is the customer’s polite way of saying no. In most cases, the customer will not follow up and call you next week to buy. “I’ll think about it” or “let me sleep on it” are typical examples of “no.”

This is when the salesman needs to offer to help the person solve the issue and come to a decision. It’s OK of they say no; what you really want to do is take away the “think it over.” You might find that there is a solution; a way you can help.

The 7 Steps to Selling according to Will Crist

Step 1: Bonding and Rapport

Any encounter with another person begins with bonding and rapport; building trust. Trust comes from keeping promises and delivering on what you say you’ll do. For some people it may be about finding out what you have in common. The goal is to be invited in.

Step 2: The Upfront Contract

Ground Rules: Thank the prospect for inviting you in; remind them why you’re there and how much time you will need to make your presentation. You might say something like, “you’re a busy person; how will we deal with interruptions? I’m turning off my cell phone. Can we go to the conference room?”

The Agenda: Let the prospect know that you will have a lot of questions and give them permission to let you know if they feel you cannot help them. Move from being a salesperson to an advisor by saying your job is not to sell something but to figure out whether or not you can help them.

Step 3: The Pain

Share your fear: The salesperson might say “My biggest fear is you’re going to take what we do here and go talk to three or tour other people; is that going to happen?” The salesperson shares their fear of being “shopped.”

Now you’re ready to learn the prospect’s fears; their time schedule, budget or issues they wish to overcome. Are they committed to making a change? Or are they happy with things just like they are?

Step 4: Money

What is the price of the product or service and how much will it help the company based on “the pain?” If the salesperson can fix the issues how much will the benefit be worth to the company? The numbers will work out to be in the prospect’s favor if they should buy.

Discuss the company’s budget of resources, time and money and how much they have allocated to fix the problem. Find out how their decisions are made and who is involved with the decision making process. Now you know who you want to have in the room when you make your presentation.

The salesperson has now completed the qualification process: pain, budget and decision. All three are necessary to give you a reason to make a presentation. This completes the pre-consulting process.

Step 5: The Ultimate Contract

Ask the prospect something like, “So after I make my presentation next week to the six people who are going to make the decision; all of you believe I can fix your problem, within your budget, what happens next?” This is how one finds out the timeframe for making a decision; this is the ultimate contract. Will they make a decision immediately after the presentation? Your goal is to get a “yes, if it is within their budget.”

Step 6: The Presentation

The salesperson is going to talk about meeting the needs of the company. Your presentation will include an outline on a board of the needs of the company. Show the group how you will solve the problems or meet their needs. Ask if they believe your product or service will be the solution. Find out how the group is feeling; get them to score you on a scale of 1 – 10 as to whether or not you can solve their problem or improve their situation.

The close is part of the presentation; the question: What is the cost? The answer: It’s under your budget. You believe we can solve your problems; it’s within your budget. At this point the salesman wants a decision; a signed contract.

Step 7: Post-Sale

The final step deals with buyer’s remorse. Thank the customer for their business and remind them of an issue that may not have been 100% resolved; something the customer gave in on; example; “Remember when we discussed how we only had the product available in blue and you wanted green? Are you sure that will be OK because we can tear up the contract right now if you want to?” The idea is to give them the opportunity to back out now; to deal with the matter now rather than later.

Next, rehearse the client. “Now you know that your other servicer is going to try to keep your business. Once they hear that you signed a contract with me, they will offer to drop their price, give you something extra; whatever you want so they keep your business. What are you going to say to them?” Hopefully, they will say that their mind is made up; they have made a good decision.

Finally, let the client know how much you will appreciate referrals when they see how well you’re taking care of them. Ask them if they are comfortable with the idea of telling others about you.

Several months later, check back with the client to be sure they are happy and remind them if they are ready to introduce you to other people. You are not asking for a referral, a name or a list of names; you want a meeting with the happy customer and other perspective clients to discuss the difference you made for your client and what you have to offer to his friends.

These 7 steps work with all types of selling, including business-to-business; business to consumer or interpersonal sales (trying to get someone to buy into your way of thinking; family and friends). Use these steps as a guide; tweak them as you see fit for your situation. The important thing is to give the clear impression that you, the salesperson, are there to help; to provide a solution; not just to make a sale.