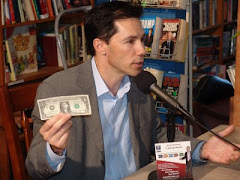

The J. Hartman Company is a good resource for investing tips and financial information. According to Jason Hartman, founder of Platinum Properties Investor Network, the borrower has the most advantage during times of inflation. Here is an example of purchasing power and the decreasing value of the dollar over time:

Let’s say that you borrow $1,000,000.00 from your banker to purchase income property at today’s interest rate. From his point of view, the banker could take that same $1 million and buy one million loaves of bread for $1.00 each. If the rate of inflation is 10% one year later the real purchasing power of that $1 million will have decreased by 10% so the banker could only buy 900,000 loaves of bread.

This scenario shows that the banker loses purchasing power when he loans you’re the money; therefore, it is better to be the borrower because it is your mortgage debt that is losing real value over time. This is good for the borrower and bad for the banker.

If you, the borrower, has made a wise investment then the value of your $1 million purchase of income property will have appreciated while the balance you owed decreases.

Jason Hartman, Founder of Platinum Properties Investor Network and the J. Hartman Company has over 20 years experience as a real estate professional. Jason began his career at the age of 19, while in college. Platinum Properties Investor Network, Inc is a comprehensive solution providing real estate investors with education, research, resources and technology to deal with all areas of their income property investment needs. Read articles and listen to interviews with Jason Hartman at http://www.JasonHartman.com

Income Property Investments without Excuses!

15 years ago

Good explanation; economics can be a tough subject; this is easy to understand

ReplyDeleteThank you for this; I'm showing it to my economics teacher; he will like it!

ReplyDeleteHey, I think I learned something like this in economics class; good article

ReplyDeleteI think I'll be the borrower; oh! I'm already in debt --- good, ha?

ReplyDeletenice blog good info

ReplyDeletegreat show -- you could charge for what you give away!

ReplyDeletei guess i pick the borrower; i have more debt than anyone

ReplyDelete