People who supposedly know about this kind of stuff say it’s dangerous to include numbers when you write. That may be true but in my opinion, numbers can be pretty exciting. The following set of numbers is visual proof that unique real estate investing strategies through refinancing is a powerful road to riches.

Roughly put, you can double your money in real estate every 12 years. While that sounds great, it’s not even the most exciting part. If you use my strategy and put the equity in your house to use, when you refinance at the end of that 12 year span, you will have an $800,000 gain in income. That works out to about $67,000 a year! Re-invest it in more real estate or retire and repeat the 12 year process.

Enough of a lead in? Here’s what you do.

Most of my clients come to me with about $300,000 in unused equity gathering dust in their home. Actually, it’s worse than gathering dust. It’s losing money, being nibbled voraciously away by inflation. I advise them to refinance their home loan and put that money to use by purchasing either two 4-plex or four 2-plex housing units in diverse geographical markets. Why diverse? It’s built-in portfolio protection if one of the local markets takes a tumble.

A Twelve Year Example:

Once you have refinanced your home and took out the equity here is a guide to investing it wisely:

1. Purchase either 2 or 4 housing units for one million dollars. To do this, you only need to put 20% of that amount down in hard cash. The bank will loan you the rest. Closing costs run about $35,000. We suggest you keep a $40,000 cash reserve in the bank to cover any initial negative cash flow in the early years.

2. Now wait 12 years.

3. After this amount of time passes, using history as our guide, your real estate portfolio will have increased in value to $2 million. It’s time to refinance again.

Here’s where it gets exciting and the true power of this refinancing strategy shines. You can now refinance the $2 million value of your properties at an 80% loan-to-value ratio. The initial 20% down payment you put on the purchase of $1 million has grown to $400,000 and will function as the down payment on the $2 million loan. 80% of $2 million is $1.6 million. You pay off the original $800,000 loan with that and have $800,000 left over.

At this point you could decide to retire and live on the $800,000 for the next 12 year cycle while you’re waiting for your properties to double again. Divide by 12 and that equals about $67,000 per year. Not a princely income but if you’re tired of working, it’s an option. On the other hand, you could take that nice little sum and leverage it (with 20% down) to purchase an additional $4 million dollars worth of properties in diverse geographical markets.

Can you imagine the sweet financial situation you’re going to find yourself in at the end of the next 12 year cycle? But let’s ignore that for now and pick up the original example where we left off.

Let’s say you decided to quit your job and live on the $800,000 for the next 12 years. Over that span of time your income property portfolio has increased in value from $2 million to $4 million. You do the refinancing process again, only this time you walk off with $1.6 million to live on for the NEXT 12 years. That averages about $133,000 a year. Nice raise, huh? Give it 12 more years and you take $3.2 million off the table for living expenses. Now you’re up to $250,000 per year. Start early enough and this is an amazing retirement plan. Don’t forget, in addition to the chunk of income cash, you also own a property portfolio worth $8 million.

And you will be renting these properties out as you go along, so your monthly mortgage payment should be covered by rent from tenants. What’s not to like about this? You only put down 20% while the bank assumes the majority of the risk. Your tenant pays off the mortgage and you own the asset free and clear at the end. This is why we encourage everyone to get off the crooked, non-returns of Wall Street stocks and mutual funds and put your money into the best investment ever created.

Real estate. They’re not making any more of it.

How do you find the right markets? That goes beyond the scope of this article but you can find every single little detail for free at my website.

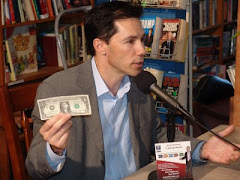

Jason Hartmann is the president of Platinum Properties Investor Network for real estate investors and entrepreneurs. Through podcasts, educational events, referrals, mentoring and software, investors can easily locate, finance and purchase income properties in any market with peace of mind.

Income Property Investments without Excuses!

15 years ago